Financing feasibility study

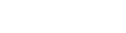

Financial feasibility studies are oriented to the market demands and guided by technology. Built around international standards, a new package of models and tools were formed in line with the international practices and market trends. Such a toolkit contributes to the integration between front-end economy and technology.

The financial analysis model is a CISDI-developed means according to The Preparation of Industrial Feasibility Studies issued by United Nations Industrial Development Organization and the accounting standards applicable for the project locations. This model has been recognised by the domestic and foreign banks and investors.

We resort to the standardised financial models and powerful data sourced from international noted institutions and database to make dynamic and trend analysis on economies of specific nodes of the project. It is a significant support for the client's decision making and the third party's financing.

Economical and Risk Analysis Model in Line with International Practices and Standards

Typical references

Name of client Country where the project is located Capacity of the project CVRD,Baosteel, Arcelor Brazil 3.70Mt CSN,Baosteel Brazil 4.50Mt MMX Brazil 1.50Mt VALE, Baosteel Brazil 5.00Mt Thach Khe IRON ORE JSC Vietnam 2.00Mt FORMASA Vietnam 20.00Mt E United Group, JFE Vietnam 7.50Mt JFE, SQUARE Australia 1.00Mt Pakistan Steel Pakistan 2.00Mt ESPP Australia 10.00Mt

A China-Tanzania company

Tanzania

1.50Mt

A mining compan

Mozambique

5.00Mt

Hong Kong International Resources Ltd.

South Africa

1.60Mt

ASSB

Malaysia

3.00Mt